One day, I look forward to sharing the news of being debt-free.

Today is not that day.

However, I wanted to share the story of another person whose life has been changed forever, and how her story affects us.

Like most of you know, when Fred and I were first married and recently graduated, we had over $90,000 in debt – the bulk of which was student loans, and a line of credit used to help pay for school and our vehicle. When we started paying off our debt after that lovely six-month grace period, we were not paying on the line of credit that Fred and his grandma had taken out.

We were making ends meet, making minimum payments on several loans, and then we started feeling guilty.

Fred’s grandma was paying this line of credit off for us (the balance was around $27,000), and we knew that we needed to help. So about 2.5 years ago, we started making double payments with grandma, and we started seeing some progress.

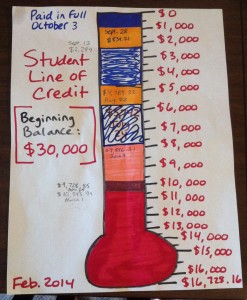

In February of this year, the balance was at $16,728. We started envisioning paying this off by the end of the year, so that grandma could enjoy as much time of the rest of her life being debt-free.

We started putting big chunks of money on this debt as much as we could. To keep us motivated so we could see how much progress we had made, I made a thermometer that I kept on the fridge that marked our progress.

You can probably guess the end of the story – we paid it off on October 3. It felt like such a huge burden being lifted – $27,000 that we didn’t owe anyone, and the end of a large monthly payment. We were so excited!

To celebrate, we took Grandma out for a nice meal. We splurged and went to The Keg (a fancy steakhouse, for those of you in America who aren’t familiar with it), where we each got a steak and ordered dessert.

(Sidenote: Each person getting their own meal sounds normal to most people, but usually Fred and I split a meal and only sometimes order dessert. This felt decadent. We spent over $100 on one meal – something we have never done before!)

As we talked and celebrated over dinner, we asked Grandma how she felt now that she was debt-free. She said, “I can’t remember a time when I wasn’t in debt.”

This was a moment I will always remember – someone’s life being changed by finally being released from the chains of debt.

We joked with her about getting another loan or having a balance on her credit card, and she just chuckled and said “No, I’ll never borrow money again.”

Even though she is 91 years old, we know that her choices have changed the rest of her life, and will change her family tree (as Dave Ramsey often says).

We still have $43,000 left to pay off, but we are are thrilled that we are past the halfway mark.

4 out of 6 of our debts are GONE.

We are working hard to pay off the remaining ones as quickly as possible. We want our chains to be broken too!

Get involved with the blog!

- Leave a comment below to keep the conversation going!

- You can also tweet me (@classyfrugality) to share your thoughts.

- Also, make sure to subscribe to my e-newsletter to make sure you never miss a post!